ChatGPT Sends Millions to Verified Election News, Blocks 250,000 Deepfake Attempts

AI

Zaker Adham

09 November 2024

08 July 2024

|

Zaker Adham

Summary

Summary

Oppenheimer analyst Yang has identified compelling parallels between Apple's current AI initiatives and its 1980s Macintosh strategy. He believes Apple is in a much stronger position now compared to the 1980s. “The Macintosh, with its graphic interface and mouse, set a new standard for user-friendliness in the early days of personal computing,” Yang noted. “This time, Apple has developed a much stronger moat around its products.”

Yang is increasingly optimistic about Apple's stock performance as the company prepares to launch its new AI software. He raised his price target for Apple’s stock to $250 from $200 in a report released on Friday, a 17% increase from current levels.

According to Yang, Apple’s integration of consumer AI within its ecosystem could accelerate revenue and earnings growth beyond Wall Street’s expectations. Apple’s tightly linked hardware and software create significant power efficiency advantages.

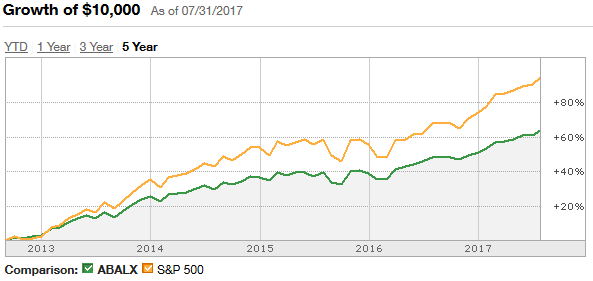

While AI is a software feature, it is limited to newer models, potentially driving demand for Apple’s latest hardware. “We believe excitement over Apple Intelligence can potentially accelerate hardware replacements and increase market share for iPhone, iPad, and Mac,” Yang wrote. Despite a 1.6% drop in Apple’s stock on Friday, it finished the first half of the year with a 9.4% increase, compared to a 14.5% rise in the S&P 500 (SPX) during the same period.

AI

Zaker Adham

09 November 2024

AI

Zaker Adham

09 November 2024

AI

Zaker Adham

07 November 2024

AI

Zaker Adham

06 November 2024