Analysts Warn of Potential Risks for Alphabet Amid Google Breakup Speculations, Despite Stock Gains

Latest News

Zaker Adham

17 August 2024

26 July 2024

|

Zaker Adham

Summary

Summary

TOKYO -- In a groundbreaking move, SBI Holdings of Japan is teaming up with U.S. investment giant Franklin Templeton to launch a digital asset management company. This joint venture aims to prepare for the anticipated approval of cryptocurrency exchange-traded funds (ETFs) in Japan, according to Nikkei sources.

SBI Holdings will control a 51% stake in the new company, with Franklin Templeton holding the remaining 49%. Franklin Templeton, with approximately $1.6 trillion in assets under management, ranks as the seventh-largest asset manager globally, as per the Sovereign Wealth Fund Institute.

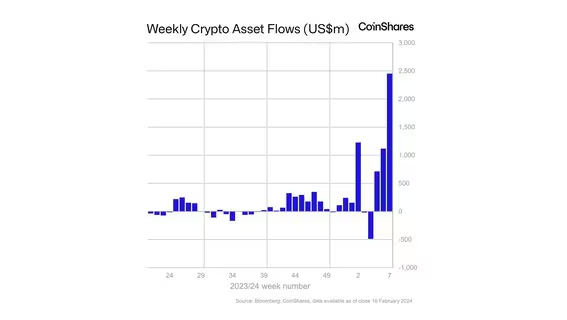

Traditionally focused on stocks and bonds, Franklin Templeton has recently expanded its portfolio to include digital assets. It was among the first to offer spot bitcoin ETFs after receiving approval from the U.S. Securities and Exchange Commission in January. According to EPFR, these bitcoin ETFs have seen inflows exceeding $16 billion in just six months.

While countries like the U.S., Canada, Brazil, Hong Kong, and Australia have approved bitcoin ETFs, Japan is yet to follow suit. However, the new joint venture will be poised to introduce crypto ETF products as soon as Japan's Financial Services Agency grants approval.

In a recent development, trading of an Ethereum ETF commenced in the U.S., highlighting the growing acceptance of cryptocurrency ETFs. Unlike traditional cryptocurrencies, bitcoin ETFs can be traded through regular securities accounts, simplifying the process for retail investors who no longer need to manage complex private keys for crypto exchanges.

Beyond bitcoin ETFs, the new venture plans to offer digital asset securities. Franklin Templeton is already a pioneer in this space, utilizing blockchain technology to tokenize assets like real estate and government bonds. A forecast by Boston Consulting Group and ADDX predicts asset tokenization could grow to $16.1 trillion by 2030.

SBI Holdings has been actively partnering with international firms to diversify its investment product offerings. Notable collaborations include the establishment of companies with U.K.-based Man Group in July 2023 and U.S. private equity firm KKR in September 2023. These partnerships aim to tap into the rising demand for alternative assets, which are sought after for their low correlation with traditional assets such as stocks and bonds.

In addition, SBI Securities, Japan’s leading online brokerage, launched a wealth management office in July 2023 to cater to the growing market of affluent clients seeking diversified investment opportunities.

Latest News

Zaker Adham

17 August 2024

Latest News

Zaker Adham

15 August 2024

Latest News

Zaker Adham

14 August 2024

Latest News

Zaker Adham

13 August 2024