China Stocks See Best Trading Day Since 2008 Amid Stimulus Surge

Stocks

Zaker Adham

30 September 2024

30 September 2024

|

Zaker Adham

Summary

Summary

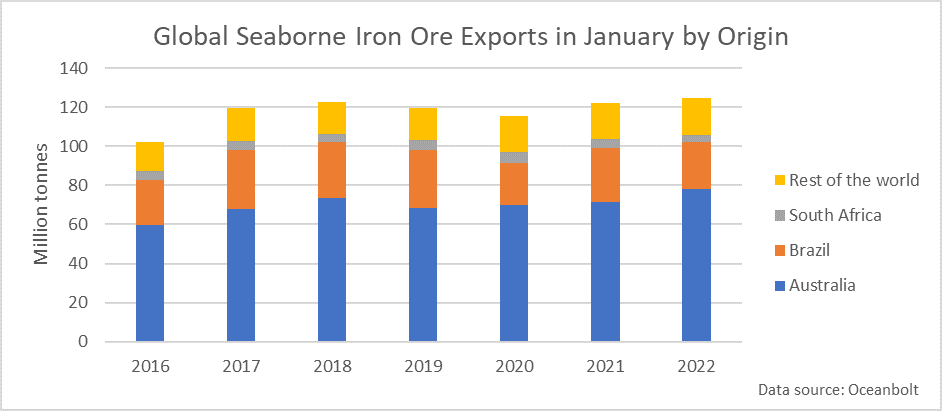

Metal stocks experienced a strong surge on September 30, driven by a sharp increase in iron ore prices and positive news from China’s property market. Iron ore prices jumped by nearly 11% after China eased home-buying restrictions in three of its largest cities—Shanghai, Guangzhou, and Shenzhen. This move is expected to boost demand for iron ore, particularly as China continues to roll out initiatives to stimulate its troubled property sector.

NMDC was the biggest gainer, with its shares climbing over 4%. Other metal stocks such as MOIL, Hindalco, and JSW Steel also rose by around 2% each. Several metal companies, including Welspun Corp, Hindalco, Vedanta, and JSW Steel, hit their 52-week highs as the sector enjoyed a wave of optimism.

The surge in iron ore prices is also mirrored in iron ore futures on the Singapore Exchange, which are now at their highest levels since July. Similarly, copper and zinc prices on the London Metal Exchange saw upward movement, signaling broader positive sentiment in the metals market.

China, the world’s largest consumer of steel-making raw materials, has been grappling with economic challenges, including a prolonged property sector debt crisis, high youth unemployment, and declining demand. In response, the People’s Bank of China (PBOC) has introduced a series of economic stimulus measures. These include reducing the reserve requirement ratio, lowering the policy interest rate, and adjusting the market benchmark interest rate. Additional steps such as lowering mortgage interest rates and standardizing down payment ratios are also aimed at supporting the property sector, which historically contributes over 25% of China’s GDP.

This positive outlook on China’s demand has bolstered confidence in metal stocks. Along with NMDC and Hindalco, other prominent companies like SAIL, Tata Steel, and Welspun Corp helped lift the Nifty Metal index by more than 1%.

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

27 September 2024

Stocks

Zaker Adham

26 September 2024