Unprecedented Bidding War Erupts Over Anysphere, Creator of Popular AI Coding Assistant Cursor

Technology News

Zaker Adham

09 November 2024

24 August 2024

|

Zaker Adham

Summary

Summary

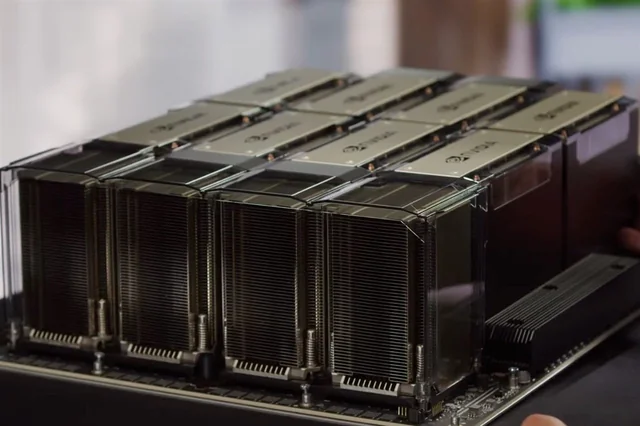

Nvidia is poised for another strong earnings report, driven by the relentless demand for AI technology, according to Wedbush Securities. As tech companies continue to pour resources into AI hardware, Nvidia’s AI chips remain in high demand, fueling the company’s growth prospects.

Wedbush, which has lauded Nvidia’s founder Jensen Huang as the "Godfather of AI," maintains a bullish outlook on the company ahead of its upcoming second-quarter earnings report on August 28. The firm’s senior vice president of equity research, Matt Bryson, noted that the massive wave of AI spending—estimated to reach $1 trillion—is still in its early stages, suggesting significant growth potential for Nvidia.

“There’s a tremendous amount of ongoing investment in AI chips, and Nvidia is right at the center of it,” Bryson shared during an interview with CNBC. Despite recent concerns that a dip in Nvidia's stock might indicate waning demand or potential challenges with its upcoming Blackwell GPU, Bryson remains optimistic about the company’s trajectory.

Nvidia’s major clients, such as Foxconn and Supermicro, have reported robust profits thanks to their AI investments, further boosting Nvidia’s outlook. Foxconn, a key buyer of Nvidia chips, saw a 6% profit increase last quarter, driven by the strong performance of its AI servers. Similarly, Supermicro exceeded revenue expectations, attributing its success to strong AI sales, even as it narrowly missed earnings targets.

“The latest data suggests that AI spending is not slowing down, which is a positive sign for Nvidia,” Bryson added.

Additionally, Bryson predicts that the integration of AI into personal devices could provide a significant boost to the semiconductor industry, as it would increase demand for AI-driven content. He also downplayed concerns about delays in the release of Nvidia’s Blackwell chips, noting that the overall momentum in AI spending would likely continue unabated.

"Even with the Blackwell launch on the horizon, the commitment to AI investment remains strong. We expect another robust quarter from Nvidia, as they’ve consistently outperformed expectations,” Bryson said. “There doesn’t seem to be any loss of momentum among their customers.”

However, some analysts have raised concerns about Nvidia’s long-term prospects. While the company’s stock has surged an astonishing 3,021% over the past five years, there are signs that demand for its chips could eventually decline. Major customers like Meta, Alphabet, and Amazon are exploring alternative options, including developing their own chips or partnering with other providers, which could pose challenges for Nvidia in the future.

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

07 November 2024