ChatGPT Sends Millions to Verified Election News, Blocks 250,000 Deepfake Attempts

AI

Zaker Adham

09 November 2024

09 July 2024

|

Zaker Adham

Summary

Summary

U.S. stock markets opened the week on a high note, driven by gains in the tech sector and anticipation of key economic events. The S&P 500 inched up 0.1%, continuing its streak of record highs, while the Nasdaq rose by 0.2%. The Dow Jones, however, dipped slightly by 0.1%.

Shares of Corning (GLW) surged by 12%, marking the highest gain among S&P 500 companies. The spike came after Corning raised its quarterly guidance, attributing the optimistic outlook to strong demand for its optical connectivity products used in AI applications.

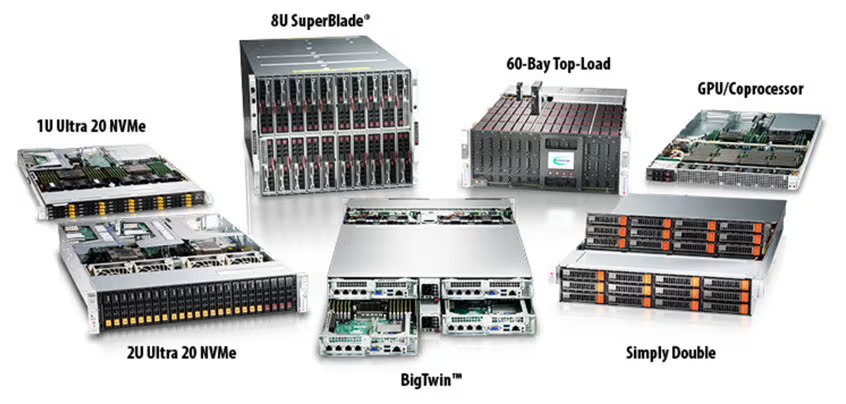

Super Micro Computer (SMCI) saw its shares rise by 6.2%, thanks to growing investor interest in AI-related stocks. The company's prominence in the AI server market, supported by its modular design capabilities, has driven its stock to triple in value since the start of the year.

Intel (INTC) also experienced a 6.2% increase in its stock price following an analysis by Melius Research. The report highlighted Intel's potential to catch up with its tech sector peers, particularly as AI integration becomes more prevalent. The analysts suggested that companies like Intel and AMD, which have underperformed earlier in the year, could see significant gains in the latter half of 2024. Intel and AMD are expected to benefit from their chips being used in Microsoft's new AI-powered devices. AMD's stock rose by 4% on Monday.

In contrast, Paramount Global (PARA) shares dropped by 5.3% after the company finalized a merger deal with Skydance Media. This agreement concluded prolonged negotiations and resulted in fluctuations in Paramount’s stock value. David Ellison, founder of Skydance, is set to become the CEO of the new entity.

Etsy (ETSY) shares also fell by 5.3% following the company's announcement to limit sales of certain products. This move, combined with disappointing first-quarter earnings and concerns over consumer spending, has impacted investor confidence.

Chipotle Mexican Grill (CMG) saw its shares decrease by 5.2%. The recent 50-for-1 stock split and criticisms regarding portion sizes have contributed to the volatility in its stock price.

AI

Zaker Adham

09 November 2024

AI

Zaker Adham

09 November 2024

AI

Zaker Adham

07 November 2024

AI

Zaker Adham

06 November 2024