Binance Derivatives Market Share Drops to 2020 Levels Amid CEX Trading Slowdown

Business Intelligence (BI)

Zaker Adham

04 October 2024

09 September 2024

|

Paikan Begzad

Summary

Summary

Concerns of an oversupply in the AI semiconductor market have been circulating after a recent report by Morgan Stanley. However, during the Korea Investment Week (KIW) 2024 held in Seoul, industry leaders from Samsung Electronics and Qualcomm refuted these claims, assuring that the semiconductor market is primed for sustained growth, driven by the rise of cloud and on-device AI technologies.

Bae Yong-chul, Vice President of Samsung's Memory Business Division, and Kim Sang-pyo, Vice President at Qualcomm, emphasized that the fears of an AI semiconductor bubble are "groundless." According to Bae, the market is experiencing a semiconductor supercycle powered by generative AI, and Samsung is making aggressive investments in memory solutions to meet the growing demand for AI-related technologies.

Samsung's recent developments include receiving certification from global server provider Red Hat for its CXL-applied DRAM, CMM-D, and ongoing work on CMM-B, a memory-sharing solution. Bae highlighted that Samsung is increasing its investment in high-bandwidth memory (HBM), crucial for supporting cloud AI growth. The company plans to mass-produce 6th generation HBM (HBM4) next year, aiming to outperform its competitors like SK Hynix. Additionally, Samsung is working on customized HBM solutions to enhance power efficiency and integrate specific functions for customers.

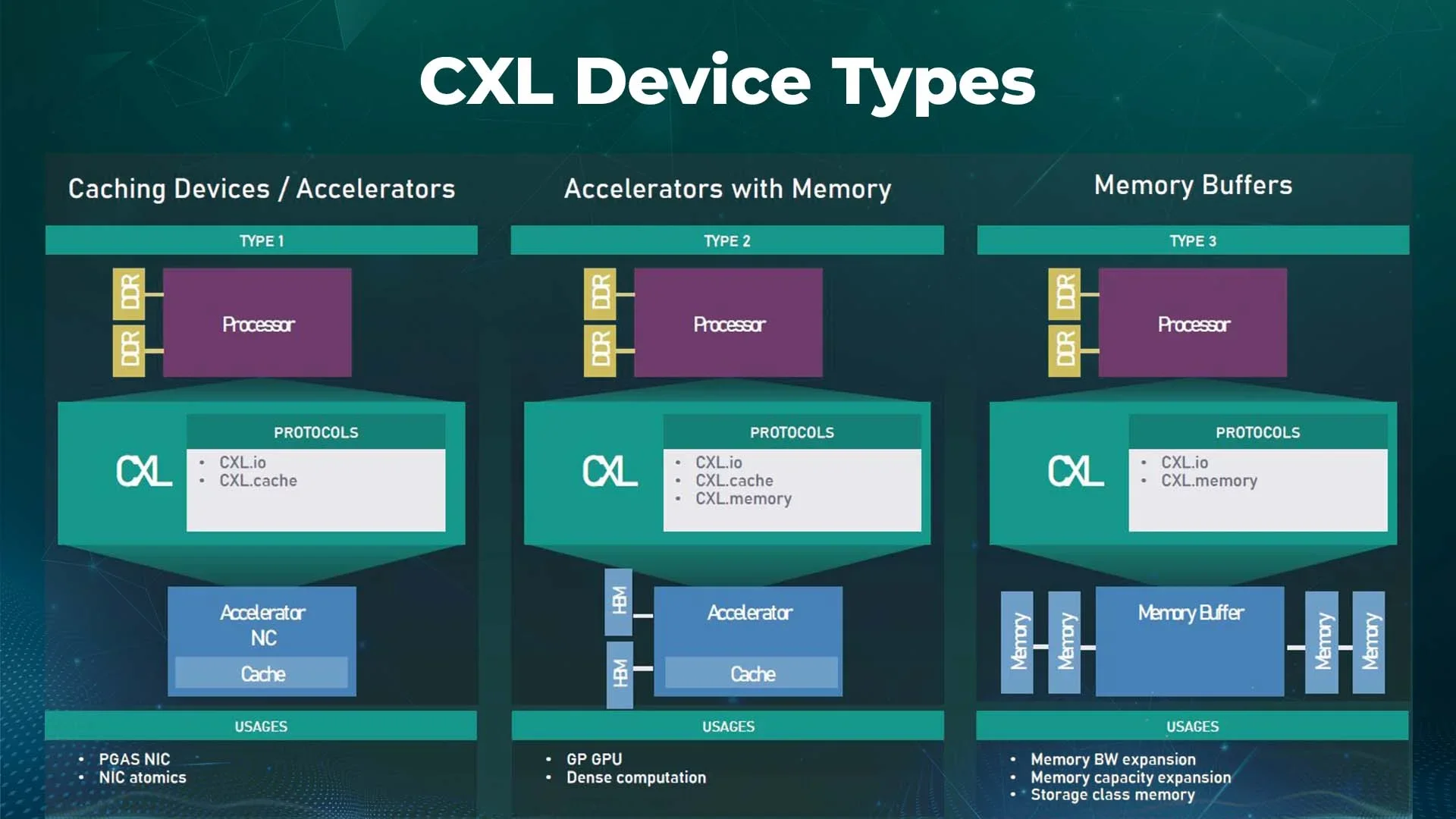

Beyond HBM, Compute Express Link (CXL) technology is becoming essential for AI servers, connecting central processing units (CPUs) with memory semiconductors more efficiently. Samsung is also pushing forward with its solid-state drive (SSD) strategy, with plans to release a 256-terabyte (TB) eSSD by 2027.

Qualcomm, a leader in on-device AI, continues to invest in developing processors for PCs, smartphones, and specialized AI-driven devices like robots. As on-device AI grows, reducing power consumption will be crucial. Qualcomm is focusing on releasing low-power memory and IP products to stay competitive in this expanding market.

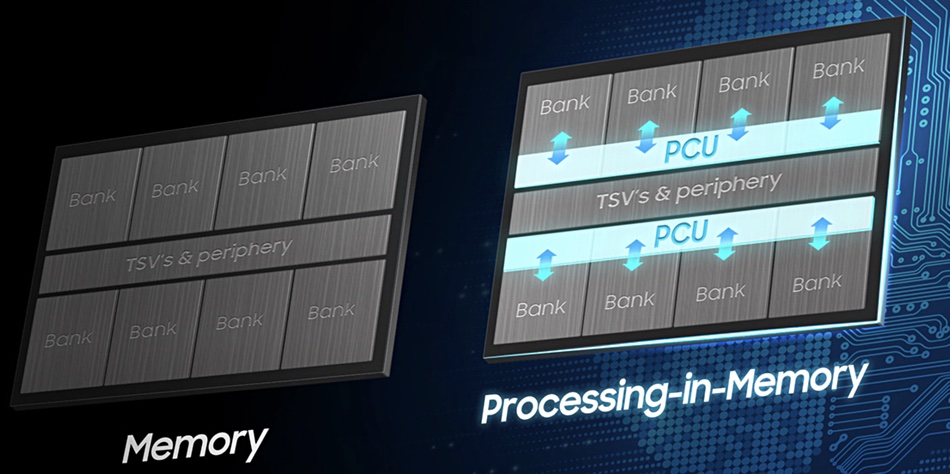

Samsung also plans to introduce processing-in-memory (PIM) technology to its mobile DRAM solutions, such as LPDDR 5X, which will further enhance AI capabilities on mobile devices.

As the debate over a potential semiconductor bubble continues, industry leaders like Samsung and Qualcomm remain confident that their investment strategies in cloud and on-device AI will drive future growth and technological advancement.

Business Intelligence (BI)

Zaker Adham

04 October 2024

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

12 September 2024