Unprecedented Bidding War Erupts Over Anysphere, Creator of Popular AI Coding Assistant Cursor

Technology News

Zaker Adham

09 November 2024

27 September 2024

|

Zaker Adham

Summary

Summary

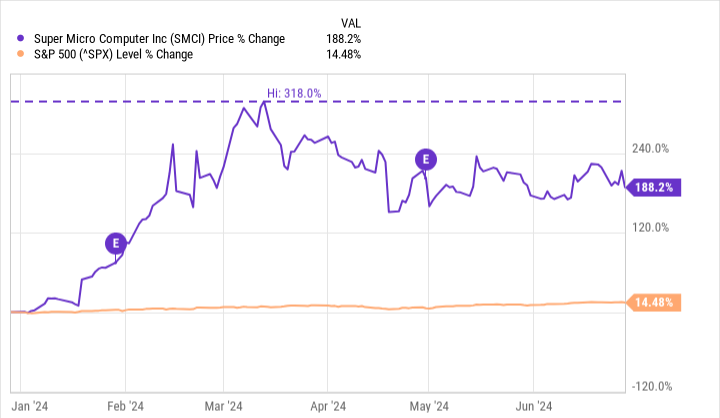

Super Micro Computer (NASDAQ: SMCI) experienced a sharp decline in its stock price today after reports surfaced that the company is under investigation by the U.S. Department of Justice (DoJ). The stock ended the day with a 12.2% drop, having been down as much as 18.6% during the trading session.

The investigation, according to The Wall Street Journal, is in its early stages and likely relates to allegations of improper accounting practices, which were raised in a short-seller report by Hindenburg Research in August. Despite today's significant loss, Supermicro is still moving ahead with its planned 10-for-1 stock split, set to take place on October 1.

Is Supermicro a Smart Buy Before the Stock Split?

Supermicro has been under considerable pressure lately, but it's possible that the negative sentiment has been overblown. The Department of Justice has yet to confirm an official investigation, and even if one is launched, it doesn’t necessarily imply wrongdoing.

The DoJ has been active recently, focusing on major technology and financial companies, having initiated antitrust lawsuits against firms like Apple, Alphabet, and Visa. Although Supermicro may not face antitrust scrutiny, the DoJ's recent investigative surge is a relevant factor to keep in mind.

If the DoJ does launch a formal investigation, it’s possible that Hindenburg’s allegations of accounting violations could be a catalyst. However, it’s important to note that Hindenburg is a short-seller, meaning it profits when the companies it criticizes see their stock prices fall.

With Supermicro now down 66% from its high earlier this year, it could present a buying opportunity for investors with a higher risk tolerance. Following today’s dip, Supermicro stock is trading at just 12 times its projected earnings for this year, and under 85% of anticipated sales—a compelling valuation for a company that has seen tremendous growth due to demand from artificial intelligence (AI) applications.

Despite the uncertainty, Supermicro’s innovative technologies, such as liquid-cooling solutions for its high-performance rack servers, could help it overcome the current challenges and regain its footing in the tech sector.

Should You Invest in Super Micro Computer Now?

Before jumping into Super Micro Computer, consider this: The Motley Fool’s Stock Advisor team has identified what they believe to be the 10 best stocks to buy right now, and Supermicro isn’t on the list. These handpicked stocks could offer strong returns in the years ahead.

For instance, investors who took Stock Advisor’s recommendation to buy Nvidia in 2005 have seen returns exceeding 75,000%. The Stock Advisor service has also consistently outperformed the S&P 500, offering members a reliable blueprint for success with regularly updated stock picks and expert guidance.

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

07 November 2024