Technology News

The Future of Art Ownership: Exploring Blockchain and Fractional Ownership

16 August 2024

|

Zaker Adham

Blockchain technology is revolutionizing the art market, extending far beyond the realm of NFTs and offering new opportunities for fractional ownership of physical artwork.

Traditionally, buying art has meant purchasing a complete piece, whether through galleries, auctions, or directly from artists. However, blockchain is changing the landscape by enabling multiple people to own a share of a single artwork.

Initially, NFTs introduced the concept of digital art ownership, where buyers could own unique digital certificates linked to a specific piece of digital art. Platforms like Opensea and Rarible became popular marketplaces for these digital assets. The value of an NFT largely depends on its uniqueness—fewer copies mean higher value, with the most prized NFTs being one-of-a-kind.

Recently, a new trend has emerged: Real World Asset (RWA) tokens, which represent ownership of physical art pieces, such as paintings or sketches. These tokens are issued by legal entities that hold the artwork and then sell fractional shares to multiple buyers. Unlike traditional group ownership, which involves complex legal documentation, RWA tokens simplify the process, making it easier to buy and sell shares on decentralized exchanges (DeFi).

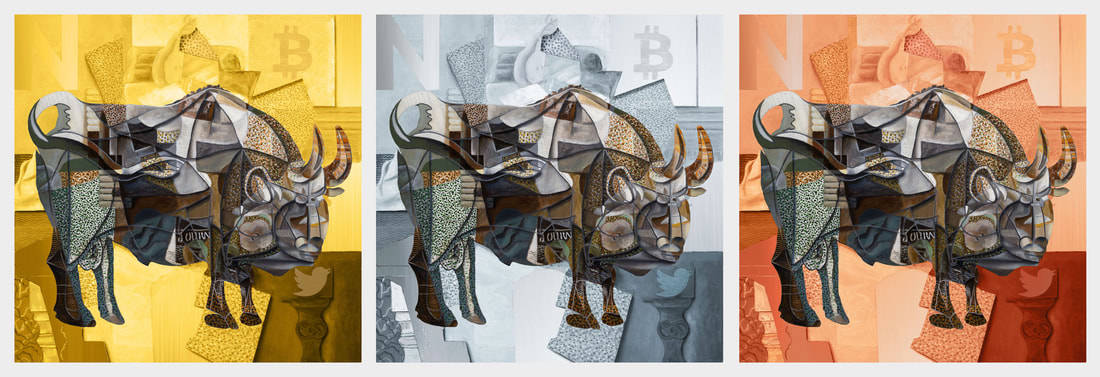

For instance, a Pablo Picasso sketch that was once privately owned is now being sold in fractional shares using a PABLO token on the Solana blockchain. This new approach not only democratizes art ownership but also adds liquidity to the market, allowing fractional owners to easily trade their shares.

The rise of RWA tokens is poised to transform the art market, just as NFTs have done for digital art. As this trend gains momentum, it could become a popular way to invest in and trade physical artwork, making art ownership more accessible and dynamic than ever before.