Fintech

Top 10 Investment Strategies for Small Investors in the U.S.: How Big Data Can Enhance Your Portfolio

20 August 2024

|

Zaker Adham

In today's data-driven world, small investors in the U.S. have unprecedented access to advanced tools that can revolutionize their investment strategies.

By leveraging big data, you can make more informed decisions, optimize your portfolio, and potentially boost your returns. Whether through predictive analytics, sentiment analysis, or the use of robo-advisors, these tech-enabled solutions offer valuable insights and strategies to help you navigate the complexities of the financial markets. By staying updated, managing risks effectively, and tailoring your investment approach, you can build a solid portfolio that aligns with your financial objectives and risk appetite.

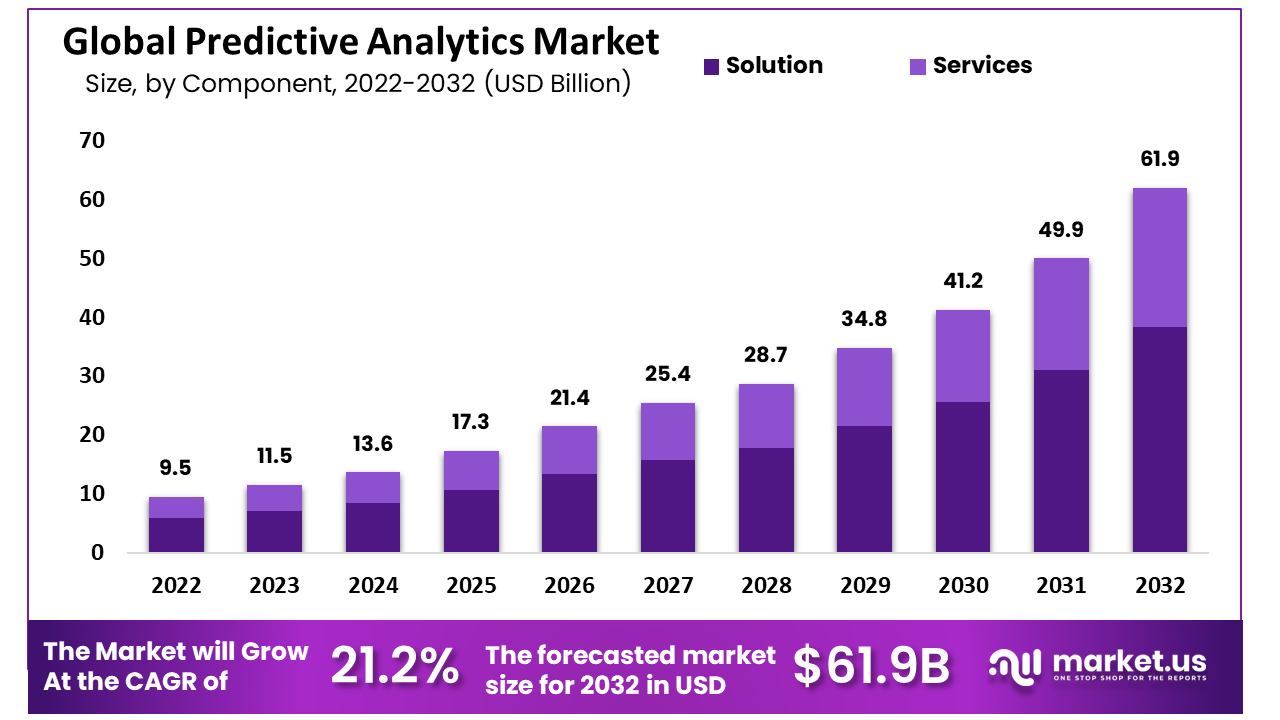

1. Harness Predictive Analytics: Predictive analytics, which utilizes historical data, statistical models, and machine learning, allows small investors to anticipate market trends and asset performance. Platforms such as QuantConnect and Alpaca offer tools to create custom algorithms based on big data, helping investors forecast market movements and make well-informed decisions, ultimately reducing the risk of losses.

2. Leverage Sentiment Analysis: Sentiment analysis involves interpreting public sentiment from news, social media, and other sources to understand market trends. Tools like StockTwits and MarketPsych harness big data to offer sentiment scores, enabling investors to spot potential opportunities or risks. Incorporating sentiment analysis into your strategy can help align your investments with prevailing market trends.

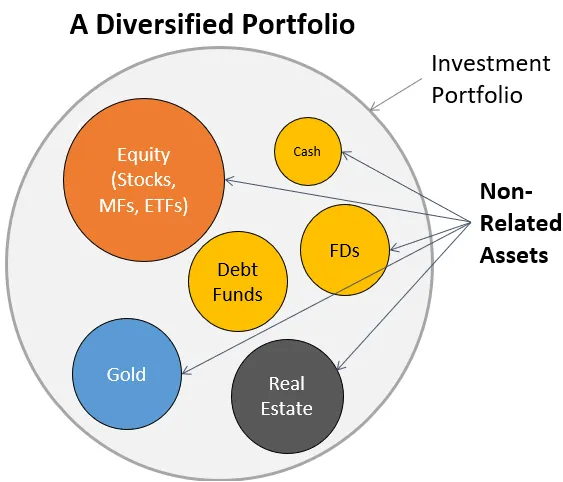

3. Diversify with Data-Driven Insights: Diversification remains key to managing risk and enhancing returns. Big data can uncover correlations between various asset classes, industries, or regions. Platforms like PortfolioVisualizer and Morningstar utilize big data to analyze historical performance and correlations, helping you build a diversified portfolio that aligns with your investment goals.

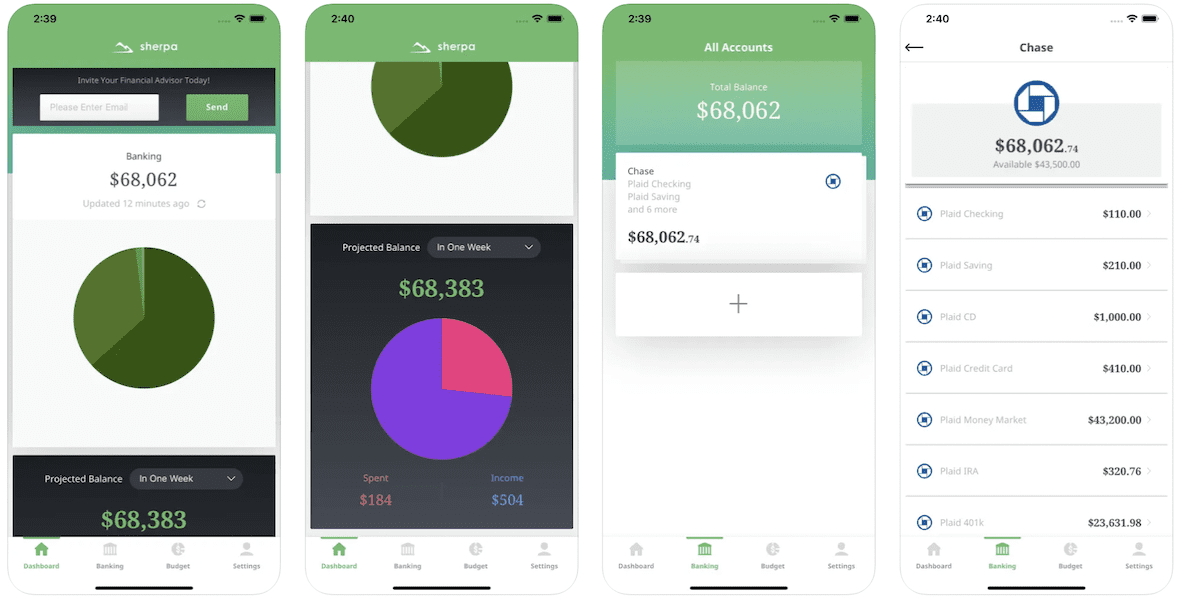

4. Automate with Robo-Advisors: Robo-advisors are increasingly popular among small investors for their affordability and ease of use. These platforms use big data and algorithms to automatically manage and diversify portfolios. Services like Betterment and Wealthfront provide personalized strategies based on your financial goals and risk profile, allowing you to benefit from sophisticated portfolio management without extensive financial expertise.

5. Implement Factor Investing: Factor investing involves selecting securities based on specific attributes, like value or momentum, which have historically driven returns. Big data is crucial in identifying these factors and applying them to investment strategies. Tools offered by AQR and BlackRock utilize big data to analyze factor performance across different market conditions, enabling investors to build a more resilient portfolio.

6. Optimize Market Timing: While timing the market is challenging, big data can provide insights to help make more informed buy or sell decisions. Platforms like Quantopian and Bloomberg Terminal offer real-time data and analytics to identify optimal entry and exit points, helping investors avoid common market pitfalls.

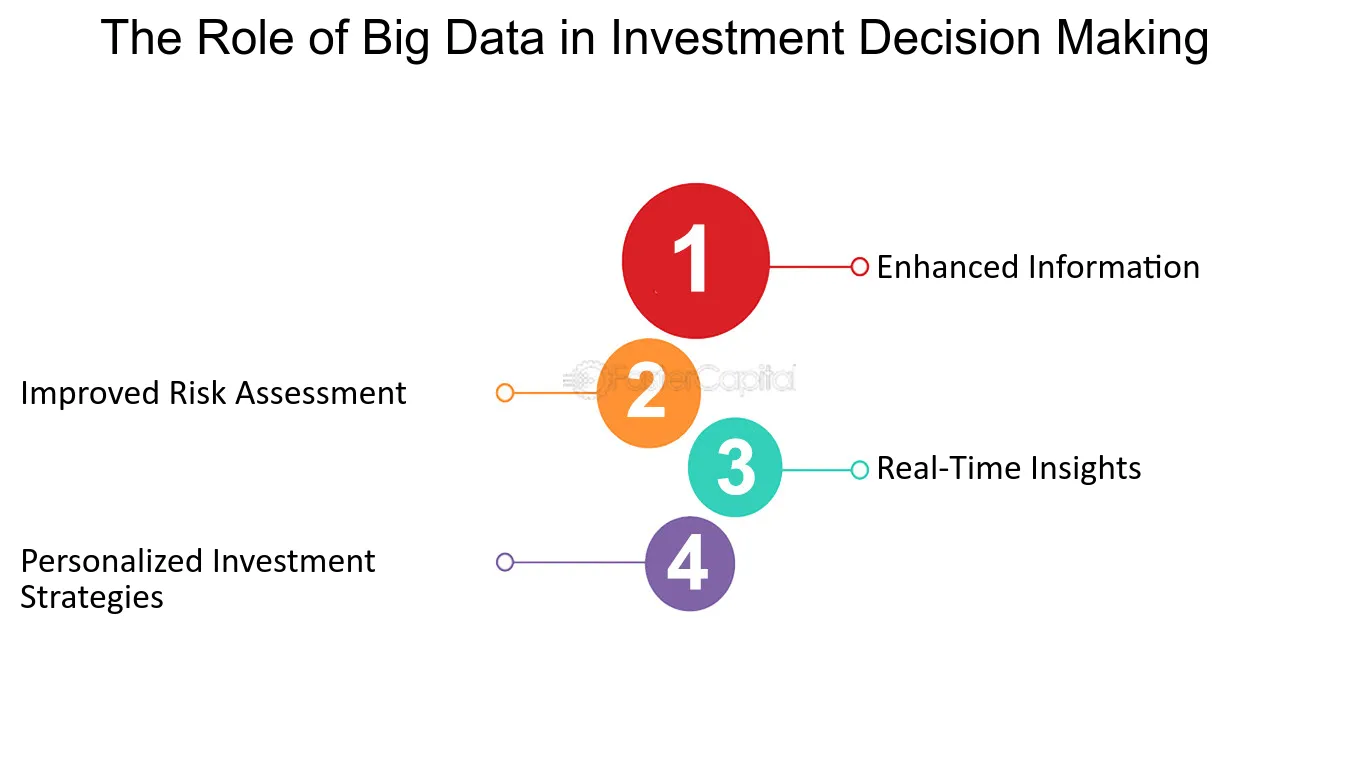

7. Enhance Risk Management: Managing risk is critical for small investors. Big data enables more precise risk assessment by analyzing a broad range of factors, including market volatility and economic indicators. Platforms like Riskalyze and MSCI offer tools that use big data to evaluate and mitigate risks, ensuring better protection for your investments.

8. Personalize Investment Strategies: Big data allows for the creation of personalized investment strategies tailored to individual financial situations. Tools like SigFig and Personal Capital use data analytics to offer investment advice based on income, expenses, and financial goals. Personalized strategies ensure your portfolio aligns with your unique needs and objectives.

9. Incorporate ESG Factors: Environmental, Social, and Governance (ESG) factors are becoming more significant for investors who wish to align their portfolios with their values. Big data provides accurate assessments of companies' ESG performance. Platforms like Sustainalytics and MSCI ESG Research offer tools to evaluate ESG factors, enabling you to make socially responsible investments while potentially enhancing returns.

10. Stay Updated with Real-Time Data: The investment landscape is constantly changing, making it vital to stay informed. Big data platforms like Bloomberg and Refinitiv provide real-time data on market trends and company performance. Staying updated allows for timely decisions and portfolio adjustments, helping to reduce risks and capitalize on new opportunities.

Conclusion: For small investors in the U.S., navigating the market can be challenging, especially with limited resources. However, by leveraging big data, you can enhance your investment strategies, optimize your portfolio, and increase your chances of achieving your financial goals. Whether through predictive analytics, sentiment analysis, or robo-advisors, these strategies can empower you to make smarter investment choices.