Technology News

Top Semiconductor Stocks to Buy Now and One to Avoid

18 August 2024

|

Zaker Adham

These stocks highlight the stark contrast between winners and losers in the semiconductor industry.

The semiconductor sector has been a goldmine for growth stocks over the past four decades, creating substantial wealth for investors. Valued at $600 billion, this industry is set to expand further in the coming decade. However, with the rise of artificial intelligence (AI), some companies are gaining an edge, while others are falling behind.

Here are two semiconductor stocks to consider buying now, and one to steer clear of.

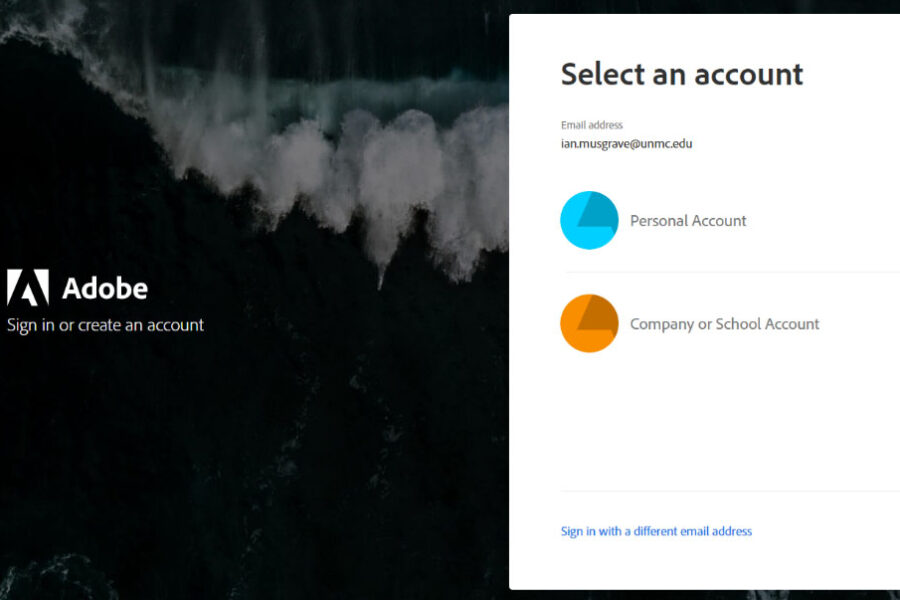

Taiwan Semiconductor Manufacturing (TSMC)

Taiwan Semiconductor Manufacturing (TSMC) is a global leader in chip production, serving clients like Nvidia and AMD. As a foundry, TSMC manufactures chips for other companies, leveraging its advanced processing technology to maintain a high operating profit margin of 42%, significantly above the S&P 500 average of 17%.

Over the past year, TSMC's stock has surged by over 82%. The company's second-quarter revenue in USD increased by 33% year-over-year. Management anticipates strong demand in the third quarter, driven by smartphones and AI-related chips, particularly as a key supplier for Apple.

TSMC is well-positioned for further growth as AI features become more prevalent in mobile devices. The seasonal dip in smartphone sales impacted TSMC's weakest market in the second quarter, but an uptick in demand could boost its momentum in high-performance computing. The upcoming launch of Apple Intelligence with the iPhone 16 this fall is expected to be a significant catalyst.

With consistent annual revenue and earnings growth, a $10,000 investment in TSMC a decade ago would now be worth over $100,000 with dividends reinvested. The stock remains a strong buy, with a forward price-to-earnings (P/E) ratio of 25, which is attractive given Wall Street's long-term earnings growth estimates of 26% per year. If these projections hold, the stock could double within three years, assuming it maintains its current P/E ratio, which aligns closely with the S&P 500 average.

Advanced Micro Devices (AMD)

Another chip stock to buy now is Advanced Micro Devices (AMD), a key customer of TSMC. The robust growth at TSMC reflects increasing demand for semiconductors among its major clients, benefiting AMD shareholders. After a recent dip, AMD shares have risen by 26% over the past year. The company is experiencing accelerated growth in its data center segment, a crucial driver for the stock. Revenue in this segment doubled from the previous year, reaching $2.8 billion, nearly half of AMD's total revenue.

AMD also saw significant improvement in its client segment, including chip sales for consumer PCs. Strong demand for Ryzen processors led to a 49% year-over-year increase in client revenue last quarter.

This momentum indicates that AMD is well-positioned for growth in the AI era. Management projects its data center GPUs to generate $4.5 billion in full-year revenue, a forecast that has been raised over the past two quarters. AMD's Ryzen chips are also expected to see strong demand as AI-powered PCs hit the market next year.

With a forward P/E of 40, AMD's stock appears reasonably priced, considering Wall Street's long-term earnings growth estimate of 43% per year. If AMD meets these expectations, the stock could be a highly rewarding investment.

Why Investors Should Avoid Intel

Intel (INTC) has underperformed in recent years, losing market share to AMD. The stock hit multi-year lows after weak second-quarter results, including the suspension of its dividend following a series of losses over the past year. Revenue declined by 1% year-over-year in the second quarter. While its client computing business posted a 9% increase, its data center and AI business saw a 3% decline.

These figures are concerning compared to TSMC's strong growth, which sets the industry benchmark. Intel is losing its innovative edge just as other companies are experiencing explosive demand from the AI boom.

To its credit, Intel is working to regain industry leadership. It recently began production on its next-generation AI chip, Lunar Lake, designed to meet the demand for more powerful chips for Microsoft's new Copilot+ PCs.

However, the AI server market is a critical battleground in the chip industry, and AMD is on track to surpass Intel in data center revenue in the third quarter. Intel's focus on expanding its foundry business, which now generates a third of its revenue, seems to have come at the expense of its core high-performance processing technologies.

Intel's struggles highlight the importance of investing in companies with growing demand for their products. This is why investors should avoid Intel stock for now and focus on companies like TSMC and AMD that are delivering strong growth.